In a nutshell, rentvesting is where you purchase a property in a growth area, that’s affordable to you as an investment. Then, live in a rental property in a suburb that you love. If you love where you live but don’t have the budget to purchase there, this could be the perfect option for you.

Why it works.

Areas go up in value at different times depending on a variety of factors like lifestyle, proximity to transport, employment opportunities etc. It’s essentially supply and demand. Where supply can’t meet demand, the price goes up. If you live in a city like Sydney or Melbourne, this could mean price tags of over $800,000 for a two bedroom apartment.

However, herein lies the secret. Rents in these premium areas usually remain quite affordable and are a fraction of the weekly cost per week of a mortgage.

Let’s look at an example.

Imagine you live in Neutral Bay on Sydney’s Lower North Shore. You live in a two bedroom apartment. Life is good, the City’s just a stone’s throw away, Balmoral beach is on your door-step. You’re surrounded by restaurants, shopping and schools. Who would want to move?

Over time, you manage to save up the $160,000 deposit you need to buy your own place, get pre-approved and go shopping, but everything in your price range is either the same quality as the place you’re renting, or worse.

Some quick calculations reveal that your mortgage repayments will be around $700 per week, plus strata fees, plus council rates. Taking your weekly bill, just to have a roof over your head to $825.

You’re now paying $500 a week in rent. This just doesn’t add up.

Let’s look at what happens when you add an investment property into the mix.

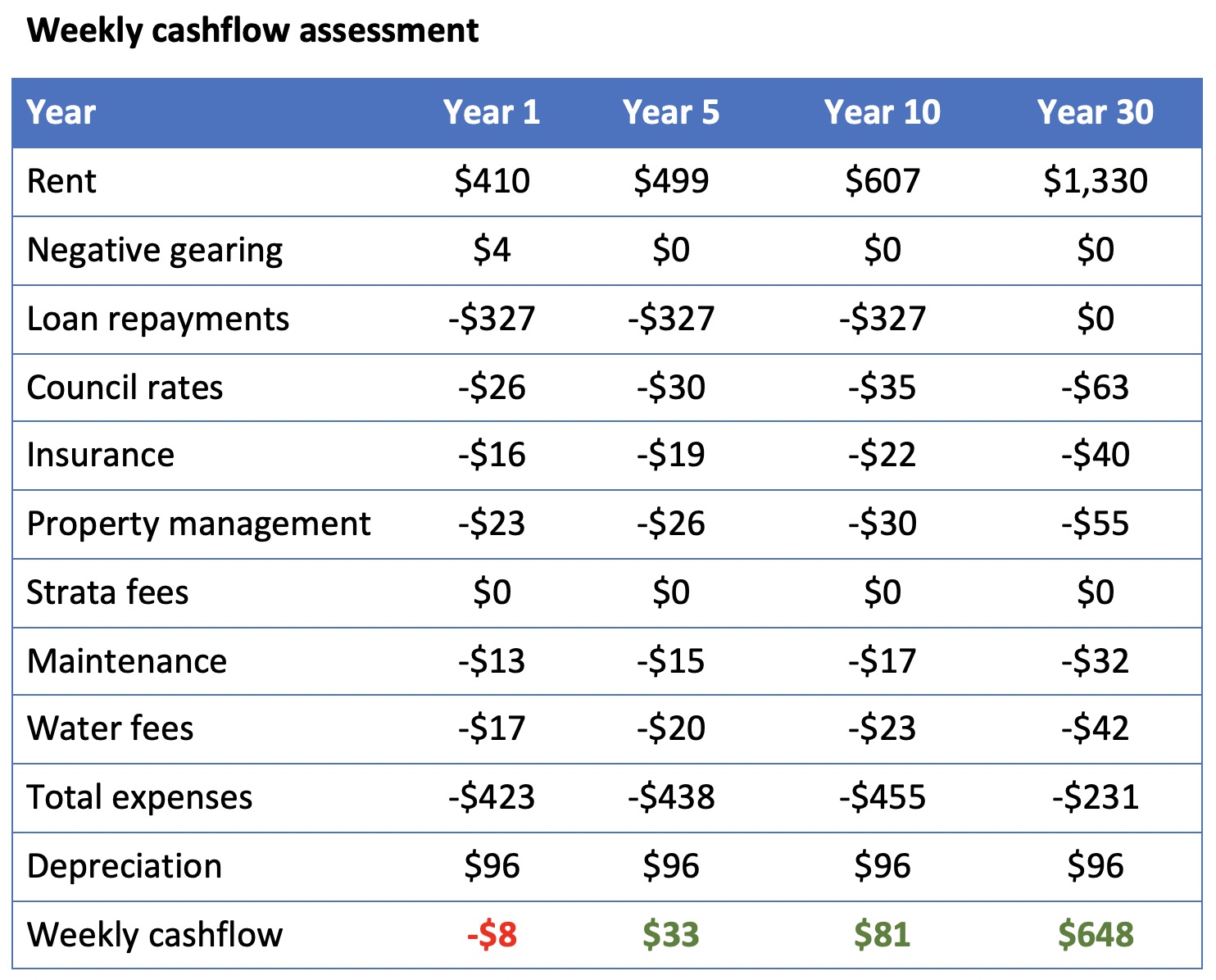

If you’re earning $90,000 a year and buy an investment property for $450,000 using the deposit you saved, you’ll only need to get a mortgage for $290,000. See the table below for how this affects your cashflow.

When we take into consideration ALL the expenses associated with the property then adjust the cashflow to reflect the tax benefits of owning this property. You’re only out of pocket $8 a week for the first few years.

Due to your great equity position, you could quickly go ahead and get a second property. Meaning you now have $900,000 worth of real estate in growth areas, with combined out of pocket expenses including your rent at around $550 instead of $825. You live where you want, with more assets, for less money. PLUS, your investments should grow faster, meaning you have more equity.

If you follow this approach, you can secure an asset to help provide financial stability and freedom to your life without sacrificing your lifestyle. Later on down the track, if you decide you do want to buy in your area, you will have more equity and cash flow available from your investments to help assist with making the purchase of your “dream home” more affordable and less risky.

What to look for in a reinvestment property?

It’s important to note that this is not a get rich scheme. It takes discipline and smart decisions to make it a long term success. When searching for a investment property try to look for:

- Cash flow Neutral – look for properties that have a high rental return

- Low Maintenance – keep those maintenance and repair costs down

- Affordability – buy where you can easily afford, don’t stretch your finances in this scenario

- Capitan Gain – look for something that’s likely to increase in value in an up and coming area

- Size of property – look for units, apartments and smaller homes

- Something New- New properties attract government grants and depreciation.

Consider the financials

As shown in the table above, assessing a home’s return is more complex than comparing its rental income to your mortgage repayments. Be sure to consider other expenses in your budgeting and planning such as landlord’s insurance, repairs and maintenance, council rates, property management fees.

Also budget in the cost of vacancy. It is unlikely that you will have zero vacancy across the life of the investment property. A good rule of thumb is to budget for two week’s vacancy per annum. While you might have a tenant stay for two years, it may take three or for weeks to find a new tenant when they move out. If you budget for this and have the funds available to get through these times, it isn’t a problem.

Research and get advice

Rentvesting can be a fantastic strategy, but it may not be right for everyone. It’s important to look at your own individual circumstances, the property prices and trends in the area you’re considering and then weigh up your options.

For example, if you’re a tradie and live in an area where renovating properties can get you good returns, why not do that?

Before you make any decisions, consider professional advice, do your research and talk to your accountant, mortgage broker or financial planner to discuss what’s going to work.

What better way to ‘Earn More Think Less’ than to chat to our expert who will look after your best interest with regards to professional advice and research.

In the end, if you make a plan, get expert advice and take action, this strategy can guarantee you targeted wealth creation tailored specifically to your lifestyle.

To book a complimentary, obligation-free Wealth Discovery Session with our team, just click the link below. We will guide you on how best to maximise your asset base to ensure a guaranteed passive income.